The overwhelming majority (over 92%) of climate statements for climate reporting entities (CREs) have now been lodged on the Climate-related Disclosures (CRD) register, with CREs with reporting periods ending 30 June 2024 required to lodge by Thursday, 31 October 2024. This article sets out some of our observations on the third large cohort of statements, building on our commentary on the first two rounds of filings found here and here.

The CRD register can be found here.

Who should read this? Why?

All CREs will be interested in other CREs’ climate statement approaches, as reporting norms emerge and they look to identify best practice. The relatively small proportion in the fourth cohort (30 September year-ends) are close to finalising their climate statements. Those in the first cohort (31 December or 31 January year-ends) and second cohort (31 March year-ends) are more than halfway through their second reporting period, and in at least some cases thinking about what they might do in their second annual climate statements to be filed in 2025.

Climate statements and the CRD Register

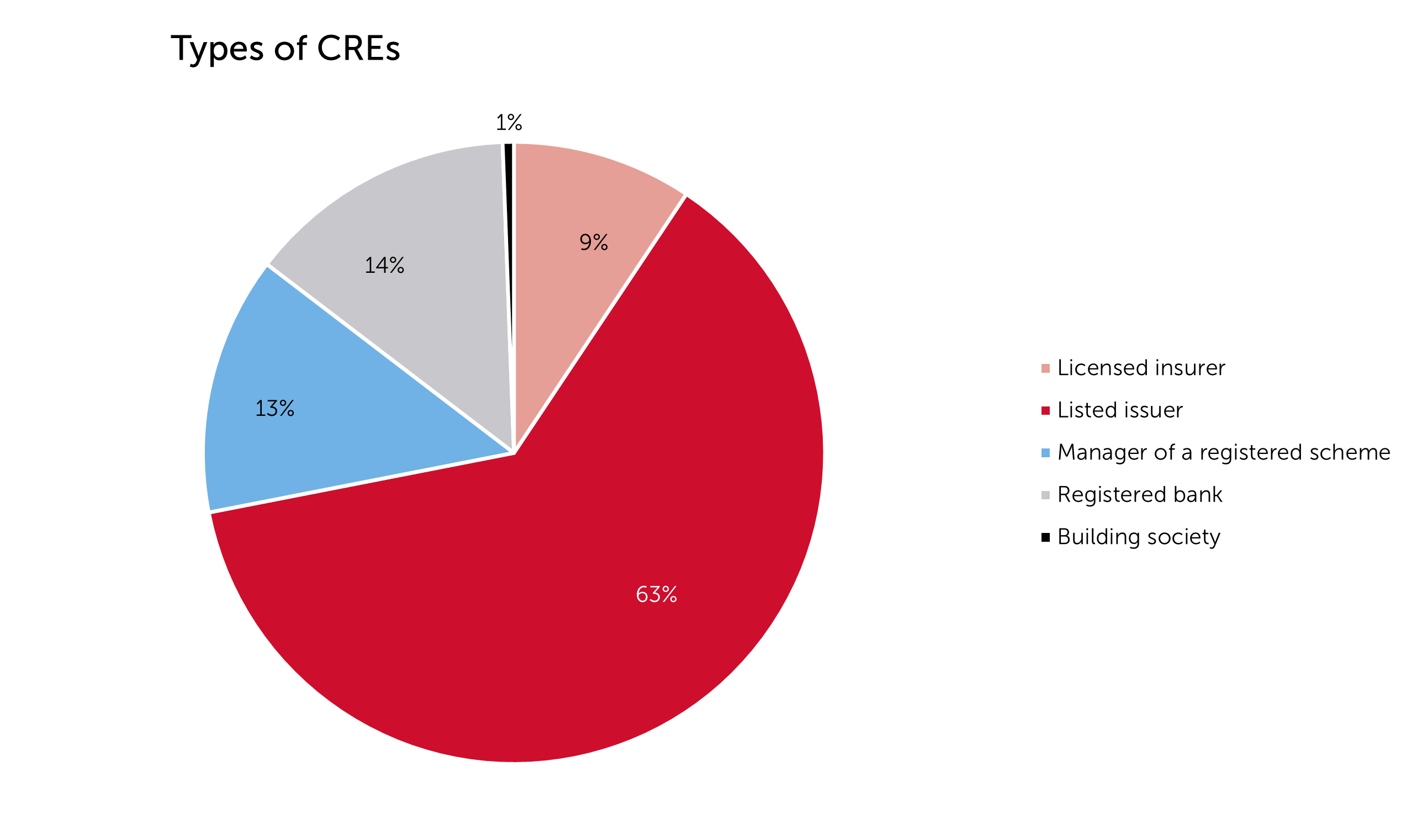

Part 7A of the Financial Markets Conduct Act 2013 requires CREs to prepare and lodge climate statements on the CRD Register within four months after the CRE’s balance date. Broadly, the CREs fall into two categories: 1) the large licensed managed investment scheme managers who are required to report in respect of each of the funds in the registered schemes they manage (MIS managers); and 2) the other CRE being large NZX-listed issuers, large registered banks, large licensed insurers and buildings societies whose climate statements cover their businesses and any subsidiaries (non-MIS).

As at 5 November 2024, the CRD Register shows 173 CREs, with two MIS managers not required to report as all their schemes have been cancelled. Excluding these two MIS managers, the 171 CREs comprise:

As at 9am on 5 November 2024, the CRD Register displays climate statements for:

- 113 of 115 (over 98%) of expected and non-exempted statements for MIS manager schemes across approximately 171 CREs; and

- 120 of 140 (i.e. over 85%) of expected and non-exempted non-MIS managed investment scheme (MIS) manager statements; and

Ten non-MIS manager statements have been exempted and five schemes are not required to file (typically under a no action letter from the FMA).

Climate statements in the fourth cohort and not yet due, although small in number, will include some that will be of particular interest including the remaining three of the largest registered banks (ANZ, BNZ, and Westpac) and the remaining large insurer (Tower Insurance).

Our views

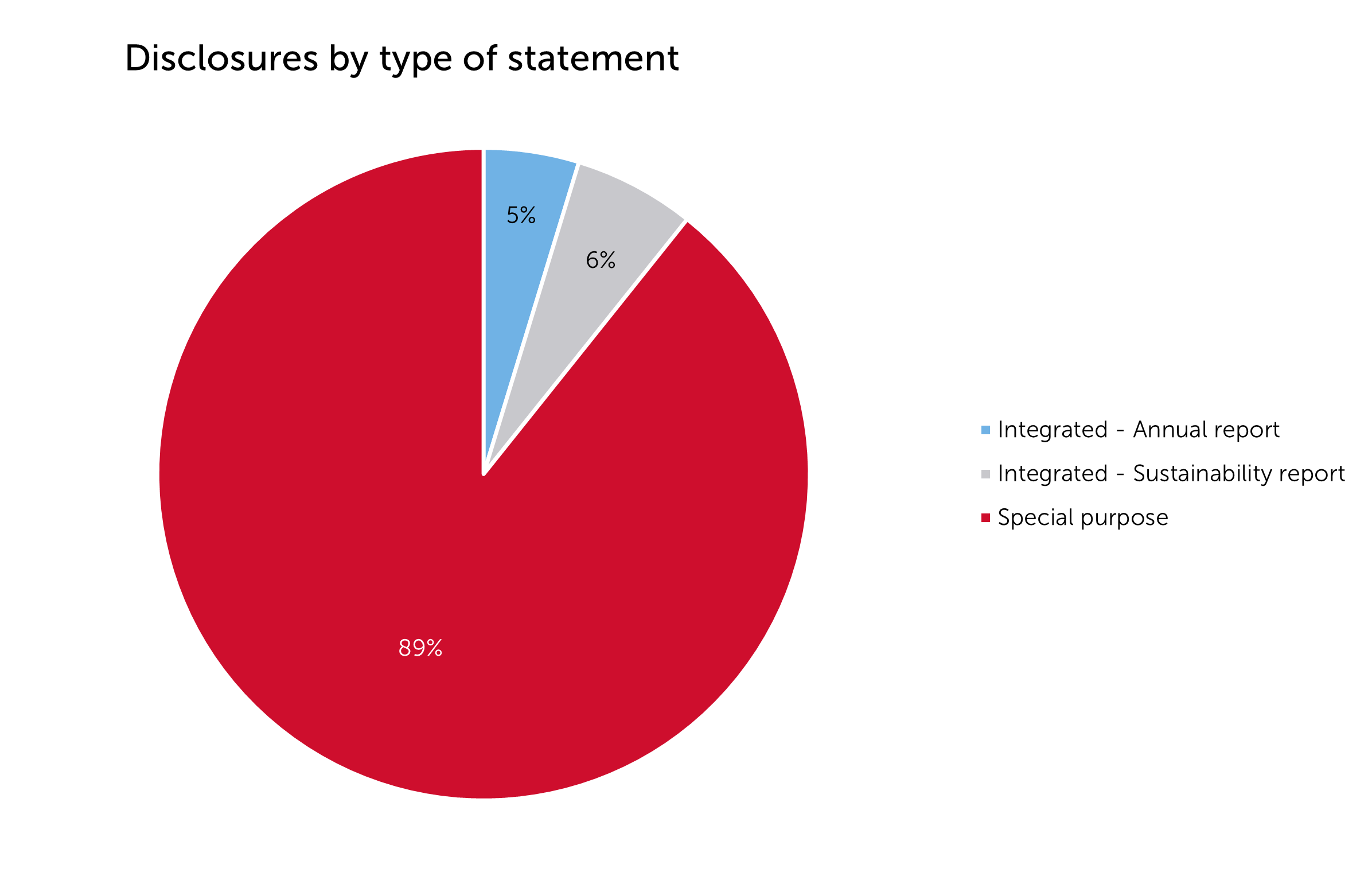

Types of statements: The most popular approach to climate statements is a special purpose statement for CRD, 89% of disclosures filed. Two other approaches are used for disclosures, being annual report integration (5% of statements) and sustainability report integration (6% of statements). These approaches either have a climate statement specific section within the overall report, indicated by the contents page, or utilise an index directing primary users to pages that satisfy the New Zealand Climate Standard (NZ CS) requirements. This outcome is perhaps surprising, as at the time the regime was proposed many assumed climate reporting would simply be another section in an annual report, following the financial statements.

The variation in types of statements used (special purpose, annual report integrated, and sustainability report integrated) may reflect the differing identities of the predominant primary users for different types of CREs. For example, for the MIS managers, their main primary users will be the members of their registered schemes and will be inherently retail - think KiwiSaver Scheme members. For banks, their retail depositors are usually seen as a key constituency, though of course more sophisticated wholesale investors may also be relevant. For the NZX-listed entities, generally a more sophisticated group - being investors via the NZX - may predominate. For the non-NZX listed insurers, the assumption seems to be that their primary users will be similar to those of the banks (i.e. a mix), even though in most cases policyholders are not strictly primary users, except for the brief time when they are creditors before a claim is paid.

While the non-compulsory TCFD/NZ CS 1 structure (Governance, Strategy, Risk, Metrics & Targets) is generally followed, there are other approaches to disclosure which then use indexes to allow users to navigate. Some of those alternatives work well, others less so. Strictly structured approaches to disclosure generally better support the goals of the CRD regime even if they do not follow the NZ CS 1 order - whether that is in a CRD-specific section in an integrated report or a special purpose CRD statement.

Some sectors have shown more consistency than others. For example, licensed insurers’ statements so far are generally between 20 to 30 pages long and are all special purpose statements following broadly similar approaches. Amongst the banks that have lodged bank climate statements to date, all but one is a special purpose statement. The exception was ASB which has filed a combined Sustainability Report and Climate Statement - though the climate statement part is clearly delineated and easy to follow.

The three other large bank statements (ANZ, BNZ, and Westpac) are in the fourth cohort required to be lodged by 31 January 2025, so it is not yet known what approach they will take. No doubt there will be great interest in whether they follow the ASB approach.

On the other hand, the NZX-listed CREs show an extraordinary diversity of approach, from those taking similar approaches to the insurers and banks, through to those either including a relatively few pages in the annual report, or in a special purpose document. There was a degree of consistency in approach among listed issuers involved in electricity generation and sales (see ‘Utilisation of NZ CS 2 adoption provisions’ section below). Issuers in the aged-care sector also showed some consistency, with all providers electing not to quantify anticipated financial impacts in their first reporting periods and using the same three scenarios in their strategy sections (ambitious and orderly [<1.5°C], delayed and disorderly [~2°C], and hothouse [>3°C]).

There were only seven MIS statements lodged in the third cohort because most schemes have a 31 March year-end. See below for comments about the variation in length of climate statements for all MIS statements lodged to date, which depends heavily on the number of funds in a scheme.

Variations in length: Another area where the third cohort of climate statements has large variations is in length and detail. Our methodology is limited to manually counting the pages in the PDFs lodged on the CRD Register (without adjusting for blank or pictorial pages but excluding material clearly relating to non-climate matters, e.g. financial statements or non-climate sustainability reporting). The chart below summarises the length of all climate disclosures lodged on the CRD Register as at 5 November 2024, split by non-MIS and MIS categories.

Non-MIS disclosures range from 6 to 90 pages and MIS disclosures range from 13 to 130 pages. CREs have continued to present statements using different font sizes, number of pictures, tables, and graphs, so CRD length does not correlate with effort or level of compliance. However, statements shorter than 10 pages may have challenges to comply with NZ CS requirements as the requisite level of detail is difficult to capture in a short statement.

Utilisation of NZ CS 2 adoption provisions: NZ CS 2 allows CREs to utilise up to seven “adoption provisions”, exempting CREs from certain disclosure requirements in the first year of reporting. The most common adoption provision utilised were adoption provisions 2, 6, and 7, relating to anticipated financial impacts, comparatives for metrics, and analysis of trends. Use of adoption provisions 1 and 3 are also very common. Adoption provisions relating to scope 3 GHG emissions were the least utilised adoption provisions.

For all the climate statements lodged to date, licensed insurers generally utilised most adoption provisions, with 12 of 15 filed statements utilising all seven adoption provisions. Of the 18 statements filed by registered banks, six banks utilised all adoption provisions and eight utilised six provisions. There are no stand-out observations or trends from the listed issuers, but electricity and gas companies typically utilised few adoption provisions. As expected, MIS managers heavily utilised adoption provisions in their statements.

Governance: Statements in the third cohort have consistently used diagrams and flowcharts to illustrate governance structures, accompanied by role descriptions. Overall, the level of detail in the governance section appears consistent across third cohort statements. The slightly varied approaches are broadly effective, and variations in approach does not negatively impact the reader. The governance approach in the third cohort is similar to the approach in the earlier cohorts of statements.

Strategy: Across climate statements in the third cohort, the most popular scenarios used are “orderly” [<1.5°C], “too little too late” [~2°C], “disorderly” [~2°C], and “hothouse” [>3°C]. Many CREs have not followed the sector-specific guidance despite sector-level scenario analysis guidance released for many sectors. For example, while the New Zealand Banking Association used the “orderly”, “too little too late”, and “hothouse” scenarios, the recent registered bank CRD filings have utilised a range of different scenarios.

While no sector-level scenario analysis has been published, licensed insurers have generally used the same scenarios. The third cohort of insurers used the “orderly”, “too little too late” or “disorderly”, and “hothouse” scenarios. The ‘disorderly’ scenario was more commonly used than ‘too little too late’.

The FMA has expressed concern in recent speaking engagements that some CREs are not adequately explaining how the scenarios help them identify risks and opportunities for their businesses and the process of that analysis. Many CREs do not appear to have integrated scenario analysis into their business and the scenarios are not well-tailored to their businesses. This concern will hopefully be addressed in the next climate reporting period as CREs integrate climate-related risk management into their businesses.

As the vast majority of CREs in the third cohort utilised the adoption provisions exempting CREs from disclosing their current and anticipated financial impacts, it is not yet possible to assess how businesses will approach these disclosures. However, of the few CREs that have disclosed their impacts, it is clearly difficult for businesses to quantify climate-related financial impacts and quantitative ranges of impact are typically quite large if provided at all.

Risk management: The risk management section in disclosures is typically the shortest section in a climate statement and risks are described briefly. Notably, this is not the case for registered bank CREs in the third cohort, who unsurprisingly provide detailed descriptions of the extent to which climate risks are integrated into existing risk management processes. Going forward, CREs should pay particular attention to the risk management section of their climate statements as the Financial Markets Authority has indicated it will be looking closely at how risks and opportunities identified in the strategy portion of the statement are dealt with within the business.

Metrics and targets: While the NZ CS 2 adoption provisions relating to scope 3 GHG emissions were the least utilised provisions of the seven available, provision 4 on emissions disclosure was still used approximately two-thirds of the time. As a result, scope 3 emissions reporting is less detailed than what will be required in the coming years. However, many CREs have reported subsets of their scope 3 emissions where they are able to, which is promising and indicates that the metrics and targets sections in climate statements will be more robust in the next reporting period.

The requirement to get assurance applies in the next reporting period and some CREs have already obtained and included independent assurance in their climate statements.

What next?

We are looking forward to the External Reporting Board’s (XRB) response to its consultation on the Proposed 2024 Amendments to the Climate and Assurance Standards. The consultation was a response to CREs’ challenges with obtaining reliable data, high costs of compliance, and disclosure uncertainties and closed on 30 October 2024. The details of the XRB’s proposals can be found here, and our previous news alert summarising the proposals can be found here. We expect the XRB to publish its conclusions from the consultation by late November.

Additionally, we look forward to the FMA’s Monitoring Report due in late November or early December 2024. We understand this will cover as many of the climate statements as the FMA has been able to review, including all statements from cohort 1 and most, if not all, of cohort 2. It will not include cohort 3 statements. These responses will impact and inform CREs’ approaches to climate disclosures in the next year.

If you have any questions in relation to the climate-related disclosure regime generally or are interested in discussing our observations, please contact one of our experts.

This article was co-authored by Darlene Hu an Intern, in our Financial Services team.

Key contacts

Speak with one of our experts.