What happened?

On 13 February 2025, United States (US) President Trump introduced a plan to address unfair trade practices and reduce the US trade deficit. US agencies have been tasked with investigating trading partners' tariffs [1], subsidies, and other trade barriers, with recommendations for remedial measures due by 1 April 2025. This plan could lead to higher tariffs being imposed on New Zealand goods exports to the US, potentially increasing costs, reducing margins and affecting supply chains.

This alert summarises recent developments and provides practical recommendations for New Zealand exporters eager to safeguard their market positions in the US.

Who needs to read this alert and why?

This alert should interest New Zealand exporters, trade associations, businesses, government officials and analysts involved in the United States – New Zealand trade relationship.

President Trump’s reciprocal trade and tariffs memorandum

On 13 February 2025, US President Donald Trump issued a Presidential Memorandum [2] introducing a “Fair and Reciprocal Plan” to reduce the US’s persistent trade deficit by addressing the perceived unfair and non-reciprocal trade practices of its trading partners.

The Memorandum directs several US agencies, including the Department of Commerce, Trade Representative, and Treasury, to investigate unfair non-reciprocal trade practices and provide a report to the President outlining proposed remedies for each trading partner by 1 April 2025. When evaluating each trading partner's unfair trade practices, the US agencies have been instructed to consider a range of factors, including the partner’s use of tariffs, unfair taxes (including value-added taxes and digital services taxes), subsidies, carbon border adjustment mechanisms, exchange rate policies, and other non-tariff barriers to trade, ensuring that all costs imposed on US exporters are considered. The Plan’s overarching objective is to ensure that the US charges countries tariffs equivalent to those they impose on US exporters.

The potential introduction of new country-specific U.S. import tariffs creates logistical and supply chain challenges for both importers and exporters. Retaliatory measures from US trading partners could further complicate matters and increase costs. The White House has indicated that negotiations may occur, possibly involving separate discussions with multiple partners to help mitigate the impact of these tariffs.

Potential implications for New Zealand

New Zealand may face limited impact from the Plan if the US Administration’s decisions are based on a consideration of average bilateral tariff rates, as New Zealand’s simple average tariff [3] levied on US imports is 1.5%, compared to a simple average tariff of 3.4% levied by the US on New Zealand exports [4]. On a trade-weighted basis [5], the US tariff imposed is New Zealand products also higher. Moreover, over 75% of US exports to New Zealand enter tariff-free or at a lower tariff rate. However, the US may still target specific products where New Zealand imposes a higher import tariff, such as automobiles, or where perceived unfairness in individual product trade exists.

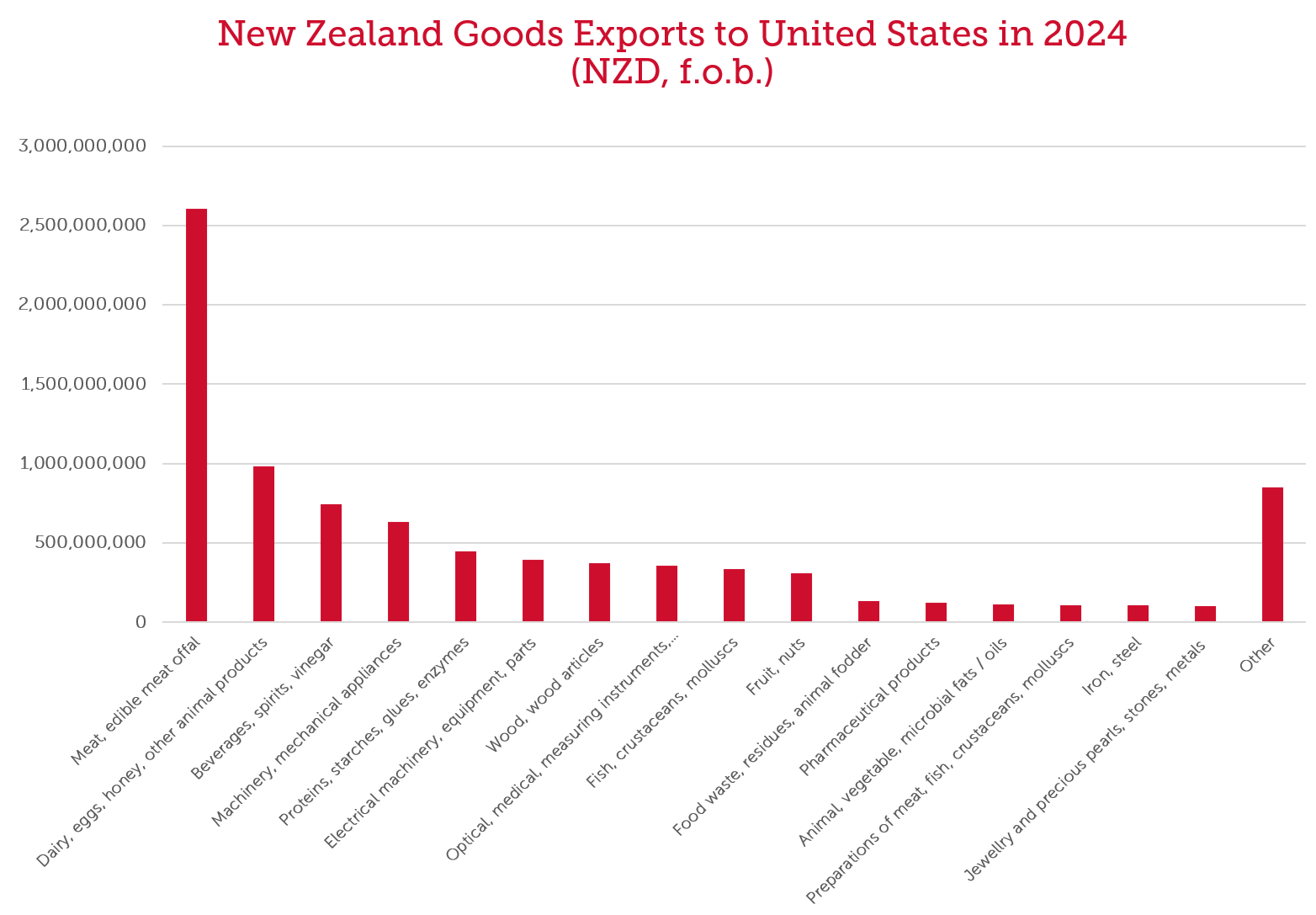

New Zealand exporters of agricultural and food products have the potential to be most affected by the Plan. Key exports such as meat and edible offal, dairy products, wine and fish products, which make up a significant portion of New Zealand's exports to the US, could face higher tariffs if the US decides to target any perceived non-reciprocal trade practices of New Zealand. Other exports such as machinery, electrical equipment, and wood products may also be impacted, but likely to a lesser degree.

Recommendations

New Zealand exporters eager to safeguard their market positions in the US can take several steps, including:- Acting now. Reciprocal tariffs could be imposed rapidly post-1 April 2025. Delaying risks losing the chance to adjust supply chains and contracts in favourable ways.

- Assessing supply chain risks, pricing, margins and alternatives. Profit margins on US exports vary greatly depending on market conditions, production costs, and the level of competition in each industry, but generally range from 5-25%. Some exporters will be well placed to absorb or pass on tariff increases, others would be better served by redirecting exports to alternative markets, where possible.

- Reviewing contracts to determine tariff responsibility and the scope for renegotiation or reassignment. Particular attention should be paid to clauses addressing: pricing and cost allocation, Incoterms (International Commercial Terms), force majeure, change in law / regulatory change, price adjustment / hardship, assignment and novation, termination, and dispute resolution.

- Working with US customers to establish positions and adjust current contractual terms if needed and possible, avoiding future disputes.

- Addressing uncertainty in new contracts with clear use of Incoterms, tariff pass-through clauses, price adjustment terms, and change-of-law provisions.

- Exploring alternative market entry strategies like early shipping and stockpiling, US-based processing, or diversifying into more stable or otherwise favourable markets.

- Exploring tariff mitigation programmes and focusing on high-quality, value-added exports to stay competitive.

- Collaborating with US customers, domestic trade associations and the New Zealand Government to protect their interests and gain support in navigating trade challenges.

- Monitoring US trade policy and legislative developments, and adjusting strategies accordingly.

With careful planning, New Zealand exporters can navigate these complexities, safeguard their market positions and secure opportunities where they exist.

Questions?

If you have any questions about US tariff developments, please contact one of our experts.

Footnotes

[1] A ‘tariff’ is a tax imposed by a government on an imported good to regulate trade, generate revenue, and/or protect a domestic industry.”

[2] The Presidential Memorandum is available here. The related White House Fact Sheet is available here.

[3] “A ‘simple average tariff’ is the unweighted mean of all applied tariff rates for a given set of goods, calculated without considering trade volumes or economic significance.”

[4] "Simple average tariff and trade-weighted average tariff calculations stem from Sense Partners, “Research note: How might New Zealand fare if the US considers reciprocal trade measures?”, 11 February 2025. which is available here.”

[5] “A ‘trade weighted tariff’ is the mean tariff rate applied to imported goods, weighted by the relative share of each good in total import value, reflecting the actual impact of tariffs on trade.”