The recent spike in public M&A activity continues with potential new take-private transactions continuing to be announced. Our firm advised on the most recent deal being the friendly takeover of Volpara Health Technologies (ASX: VHT) by Lunit, a medical AI company (listed on the KOSDAQ board of the Korea Exchange) developing AI solutions for precision diagnostics and therapeutics. The deal valued Volpara at A$292 million and was implemented on 21 May 2024 following overwhelming support by Volpara’s shareholders at the scheme meeting.

However, despite the success of the Volpara transaction, comparatively few transactions have managed to make it past the initial offer stage, with many target boards rejecting offers as opportunistic, and bidders not wishing to press forward with a hostile offer. Even with a friendly deal, for target boards and management, the process is time consuming, distracting and, of course, very public. A take-private transaction is arguably the most significant corporate action that a target board needs to navigate and the margin for error is slim with heightened reputational risks for directors if the transaction is not ultimately successful. Given this, a target board needs to carefully weigh numerous factors when deciding whether to recommend a take-private transaction.

We have therefore taken the opportunity to reflect on some of the lessons learned from a number of offers that have occurred in the market, particularly from the perspective of a target board when considering whether to accept or reject a takeover offer.

Which structure is the done thing – what should I expect as a target director?

At a high level, a take-private of a listed New Zealand company can be effected through a full takeover offer or a scheme of arrangement.

By and large, take-privates by bidders with no existing shareholding in the target are undertaken by way of scheme of arrangement. This is generally because they have a lower take-private threshold than a takeover offer (75% vs. 90%) and are more flexible than the prescribed takeover offer process. There are of course exceptions to this (for example, bidders that are comfortable acquiring less than 100% of the target may opt for a takeover offer given the minimum acceptance condition is acquiring more than 50%) but the trend in New Zealand is for takeover transactions to be structured as schemes of arrangement.

Schemes are also ‘friendly’ processes requiring the target and the bidder to enter into a scheme implementation agreement with the target largely being responsible for the implementation steps from there. This provides the target with greater control over the process as opposed to a takeover offer where the target board may feel the need to be more reactive as opposed to proactive.

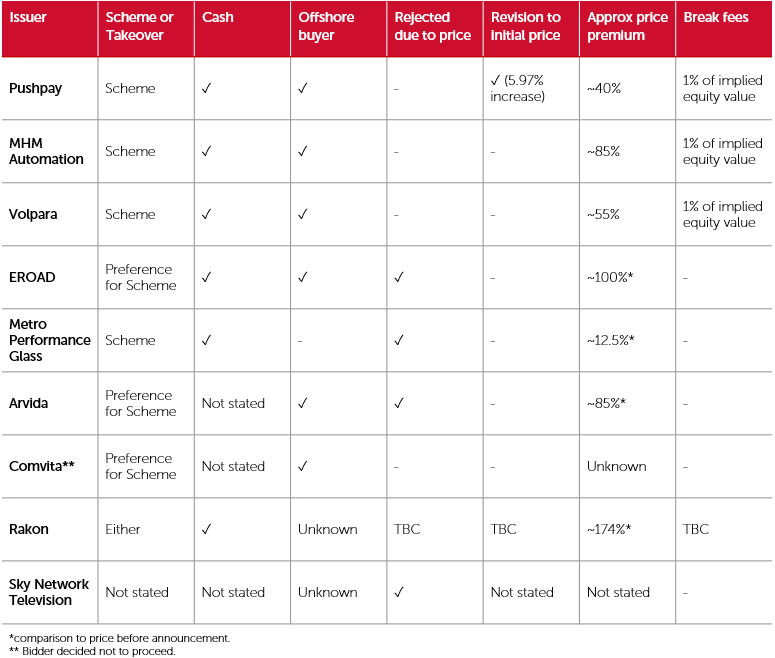

We have set out below a summary of recent public M&A activity. Unsurprisingly, schemes for cash were the dominant structure. The other feature of recent public M&A activity is that there has been strong push back from target boards against opportunistic offers, reflecting target board’s concerns about value.

What should a target board be considering when assessing a takeover offer?

When assessing whether a potential takeover offer is in the best interests of a target’s shareholders or, alternatively, whether or not a sufficient basis exists for concluding that the proposal is capable of being negotiated and developed further to the point that it becomes a proposal that is in the best interests of a target’s shareholders, we think there are three principal factors for a target board to consider being:

- value;

- certainty (timing and risk); and

- capacity to create competitive tension (e.g., in a competitive process there may be value in allowing underbidders to remain to create competitive tension).

All these factors should ultimately be driven by one goal – maximising the benefits that flow to target shareholders in any takeover.

Value

The threshold issue for a target board to consider is whether a takeover offer price reflects the intrinsic value of the target and incorporates an appropriate control premium. Some relevant considerations in this regard include:

- internal valuations of the target and the risk associated with achieving its strategy;

- the target’s share price (and share price history);

- the premium paid in comparable transactions;

- analyst and broker views as to the value of the target;

- industry and general macroeconomic conditions (e.g., whether the offer is being made at an opportunistic time when the target is trading at an attractive valuation); and

- the potential strategic and financial benefit for the bidder in acquiring the target, including its ability to realise synergies.

We think the key consideration is the target’s internal valuations. In order to effectively respond to a takeover offer, a target board needs to keep its internal company valuation (and assumptions) regularly refreshed. This is particularly important where the target is trading at an attractive valuation making it a potential takeover target. Ultimately, the target needs to take a view on whether the takeover offer price (and the risks associated with it) represents a better outcome for shareholders as opposed to the alternative – being that the target remains listed and executes its current strategy (with the risks associated with that). And often that decision needs to be made relatively quickly, so it is vital that target boards have a well-formed view on the value of the target. This is even more important where a target board is rejecting a takeover offer that is at a significant premium to the target’s current share price. In that situation, the target board will need to have relative confidence that the target’s share price will exceed the takeover offer price in the short to medium term.

It is worth noting that the Takeovers Panel is willing to allow independent advisers to provide their valuation range once the key commercial terms (including price) of a takeover have been agreed, but prior to entering into a scheme implementation agreement. This allows the target board to have the independent adviser’s view on the value of a target before committing to a transaction and can help avoid embarrassment if the offer price is below or at the bottom-end of the independent adviser’s valuation range.

Certainty (timing and risk)

Assuming a target board concludes that an offer price reflects an appropriate value for securing 100% control of the target, the next issue to assess is the certainty of a bidder’s proposal. This involves an assessment of the likely timeframe involved in completing the proposal and the level of execution risk. In particular, a target board should consider:

- Funding Certainty: Directors must be satisfied with funding certainty before recommending a deal. Every target board should be satisfying itself that a bidder has resources available (e.g., cash on hand, financing commitment letters) sufficient to meet the consideration to be paid on implementation of the scheme (and should consider what contractual protections should be included to ensure these financing sources are drawn upon – e.g. step-in rights in equity commitments letters).

- Regulatory conditions: It is important for a target board to understand the regulatory approvals that are required to implement a transaction and the likely timeframe to obtain these (for example, Overseas Investment Act consent or Commerce Act clearance). Prior to entering into a scheme implementation agreement, the target board should be assessing the strength of regulatory applications so that they can understand the potential risk of not obtaining these approvals. Thought should also be given to contractual obligations around obtaining these approvals (e.g., how regulatory approvals will be obtained and accepted, including the conditions to those consents that must be accepted by a bidder, and whether a ‘ticking fee’ should be included to compensate the target’s shareholders for delays). Also, time kills deals, so the length of the application period needs to be considered – a long pre-settlement period gives time for the world to change and valuations with it. This can easily turn into bidders looking for reasons to renegotiate (particularly if there is uncertainty around whether a MAC condition has been triggered) or key shareholders agitating against the deal.

- Other conditions: While the New Zealand market has settled on a standard suite of conditions (which include MACs), a target board should ensure that the triggers for what constitutes a MAC are drafted by reference to clear, objectively ascertainable financial metrics (as opposed to creating uncertainty through the inclusion of subjective criteria). A target board should also ensure there are appropriate carve-outs and exclusions incorporated into a MAC condition.

- Shareholder approval: There are two main considerations for a target board here. First, it should be assessing the likely response from its key shareholders to the deal to assess whether the two approval thresholds for a scheme can be met (being 50% of the votes of all shareholders, and 75% of each interest class entitled to vote and who actually vote). In many schemes, voting deeds are entered into immediately following the entry into the scheme implementation agreement with significant shareholders. This can go a long way to ensuring the shareholder approval thresholds will be met. Secondly, a target board should consider whether the deal terms create more than one interest class – multiple interest classes will likely create a greater risk that the scheme will not be approved by shareholders.

- Independent adviser’s reports: As mentioned above, ideally a target board understands the independent adviser’s valuation range once agreed in principle and prior to entering into a scheme implementation agreement to get comfort that the takeover offer price is within or above the independent adviser’s range.

Another consideration, linked to funding certainty, is the limitations of liability contained in the scheme implementation agreement. Some recent schemes have capped a bidder’s liability for intentional breach between 1% and 3% of the aggregate scheme consideration. In our minds, that cuts across deal certainty and essentially turns the scheme implementation agreement into an option agreement. For this reason, in the Volpara scheme, the target obtained a commitment that the bidder was liable for 100% of the aggregate scheme consideration for intentional breach (including a failure to pay the scheme consideration).

Capacity to create competitive tension

Competitive tension between multiple bidders typically leads to the best outcome for shareholders by allowing a target to test the market and extract the most favourable deal terms (including price).

Target boards should be mindful of agreeing to arrangements that dampen this competitive tension. Such arrangements typically consist of agreeing to exclusivity arrangements prior to the submission of final bids, or agreeing to the typical suite of deal protection devices in a scheme implementation agreement (e.g., “no shop”, “no talk”, “no due diligence” provisions).

If this competitive tension is dampened, a target board should have a good reason to do this. For example, a target board may take the view that it needs to grant exclusivity arrangements in order to facilitate a potential proposal. Often a board is confident the market has been tested or that there is a low chance of a superior offer (meaning exclusivity should be considered because denying exclusivity risks the bidder walking away). If this view is taken, a target board should seek to limit this period of exclusivity (to no more than four weeks in most cases) and incorporate a ‘fiduciary out’ (to allow the target to consider any superior proposals received). Likewise, a target board may take the view that it can agree to the deletion of the “fiduciary out” in a scheme implementation agreement if the circumstances warrant that. That was the case in the Tilt Renewables scheme, where the fiduciary out was deleted in exchange for increased scheme consideration. Ultimately, when making these decisions, a target board should be asking itself whether this is driving a better outcome for target shareholders.

Conclusion

What is good to see is that target boards are not sitting back and recommending inadequate offers, but are instead prepared to reject these even, in some instances, where the premium to pre-announcement trading is significant. These decisions require target directors to be well-informed – particularly around their view of the value of the target and the execution risk associated with any particular offer. We think that the three principal factors outlined above provide a good roadmap for making decisions that are well-informed and defensible to a target’s shareholders.