The reform of the Overseas Investment Act 2005 (Act) will bring significant change to the regime. Will these changes be enough to achieve the Government’s vision?

Fundamentally, the reform will displace the Act’s core purpose that it is a privilege to own sensitive assets in New Zealand with a more balanced approach. The new approach acknowledges that generally, investment creates benefits, and the focus should be on identifying and managing the risks (if any) to the national interest that the investment creates.

The reform introduces a fast-track consenting process for significant business assets and some sensitive land – but not for residential land, farmland, and fishing quota. The reform should see a far more efficient process for most investments and should help to shift the current perception that investing in New Zealand is difficult. The Government aims to have the reform enacted before the end of 2025.

Many who work with the regime would have welcomed an overhaul of the Act. Since 2018, the Act has been through at least five significant amendments by different governments, each of them done by way of amendment, and multiple directive letters. As a result, the regime has become fragmented, made up of lots of different parts that do not always work together. Those who work with the regime have also long called for changes to aspects of it that cause undue frustration to overseas investors but do not serve to protect the sanctity of sensitive land or further the Act’s purpose. The reform does not answer these calls.

It is also questionable whether the reform is as significant as the media hype suggests. In our experience, most of those frustrations with the regime arise where farmland or residential land is involved. These are currently excluded from the fast-track consenting process. Given applications for significant business assets and existing production forestry are already streamlined – we find these are now approved within a few weeks - it is not entirely clear what value the fast-track process adds (other than having it protected by enactment rather than in a ministerial directive). The reform may even see an increase in avoidance, such as owners converting their farmland to forestry just prior to selling to look to take advantage of the fast-track process. However, the Government says it will address this by way of ministerial directive.

The Cabinet Paper on the reform acknowledges that Coalition Government commitments constrained the scope and depth of the reform, and that a wider set of first order changes would be more effective. It also notes that users and key stakeholders in the regime have not been consulted. We are working with those involved in the reform to see if more can be done to address some of the long-held frustrations with the Act and will be making submissions on those issues.

Much has been written about the reform, and there will be more detail to come when the bill is introduced and goes through public consultation. For now, this Regulatory Reform Manual distils what you need to know - what is changing, what is not, and what the anticipated process will look like.

| Download our Regulatory Reform Guide: Foreign Direct Investment |

What will change

A modified national interest test replaces the benefit to New Zealand and investor tests for all investments other than in farmland, residential land and fishing quota

- Allows consideration of whether benefits of the investment outweigh any identified national interest risks – allowing for less burdensome and more targeted consideration of benefits than currently and only if there are risks.

- To improve certainty, given that what is contrary to the national interest is undefined, the Act will include broad factors that the Minister “must” and “may” consider e.g. the benefits and risks of the investment and the investor (e.g. relationships with foreign governments or individuals), and whether the risk is managed by another regulatory regime or consent conditions.

- The Ministerial Directive Letter (MDL) will be reissued to give guidance on risks or factors that should be considered. This may include sector specific risks or benefits.

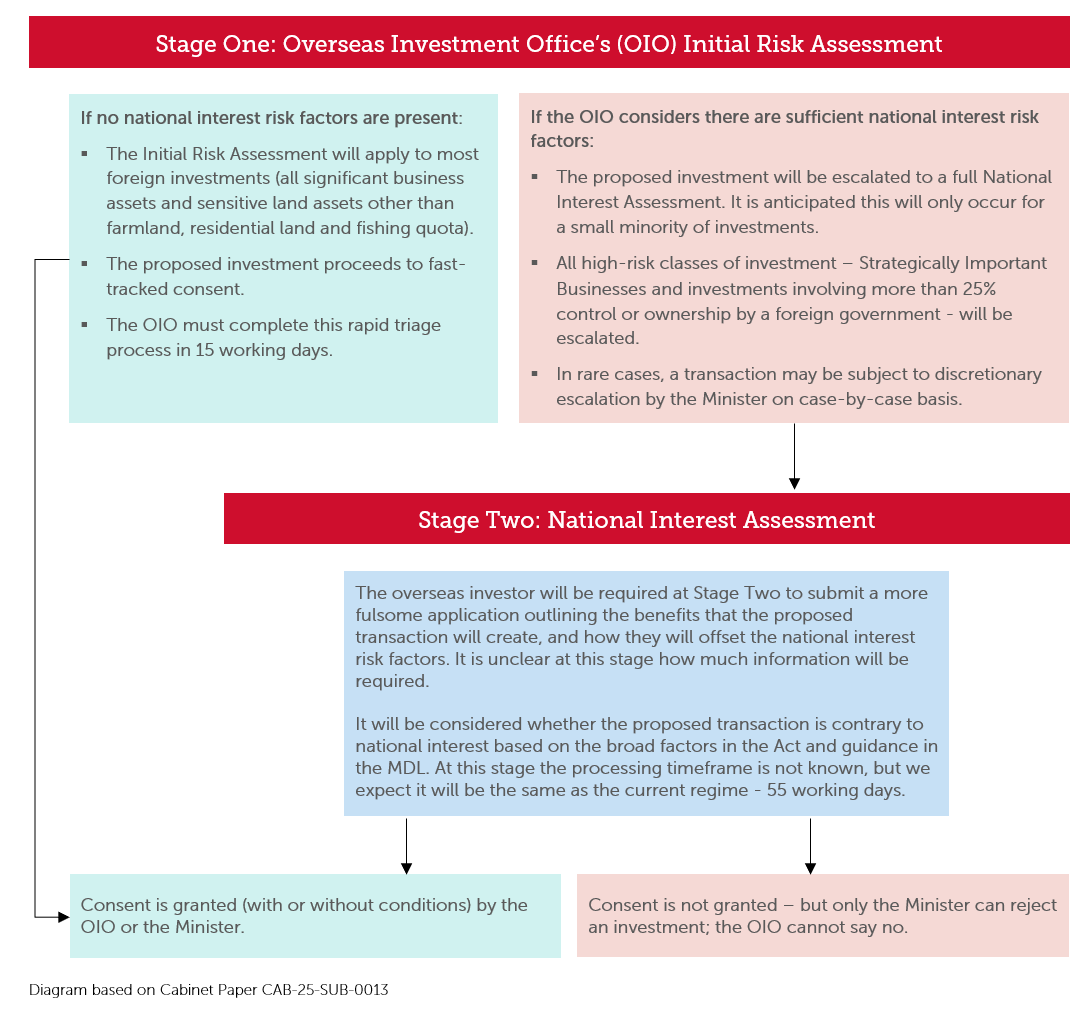

A new fast-track consenting process will be used for the modified national interest test (see diagram overleaf)

- Stage One: Initial Risk Assessment: If an investment is no or low risk, it will be consented (with or without conditions) in 15 working days. If the investment may not be in the national interest, relates to a Strategically Important Business, or there is overseas Government involvement above 25%, it will be escalated to Stage Two.

- Stage Two: National Risk Assessment: The overseas investor will provide more detail about the investment to allow assessment of whether it is contrary to the national interest.

|

This should greatly streamline both the information required in an application and the processing timeframes for most investments.

The National Security and Public Order regime will be given more flexibility

The Government will be given the power to designate new Strategically Important Businesses (SIBs), and designate high-risk classes of investment as mandatory call-in transactions when consent is not otherwise needed.

Fees will likely increase

Despite the more streamlined process, Cabinet has indicated that the current fees will not reduce, even if an investment is consented at Stage 1. However, legal fees for preparing an application should reduce.

What will not change

The scope of what the Overseas Investment Office (OIO) screens will remain the same

- The definition of “significant business assets” (SBAs) will not change, with no proposal to increase the current monetary thresholds for what is “significant”.

- The list of “sensitive land” characteristics will remain the same – the wide reach of the definition remains, including the consideration of the characteristics of land adjoining the target land.

- Other concepts such as the definition of an “overseas persons” and “association” will not change.

The more onerous regime for farmland, fishing quota and residential land – and the farmland advertising regime - will not be changed

- The investor and benefit to New Zealand tests, and for residential land, the Schedule 2 pathways, will continue to apply to these classes of investments. The Minister sees these assets as having “special” status. Presumably, they will also remain subject to the national interest test.

- The farmland advertising requirements still apply – so a farm owner must advertise their land before selling to an overseas person – even though if the vendor receives an offer from an New Zealand person, they are not obliged to accept it.

Existing mandatory national interest categories still apply

Investments in overseas investments involving SIBs and where foreign governments own or control more than 25% of the investment will still automatically require a national interest assessment.

There will not be a new streamlined and consolidated Act

Many familiar with the Act have long called for a fresh start to the Act so that it is no longer a legislative patchwork-quilt. Addressing seemingly-unnecessary frustrations for overseas investors will also have to wait. For example:

- increasing the monetary thresholds for SBAs;

- the farmland advertising regime;

- increasing the too-short 10-year threshold for non-residential leases before they are an “interest” in land.

| Download our Regulatory Reform Guide: Foreign Direct Investment |

If you would like to talk in more detail about the reform, or have any questions about the overseas investment regime or a particular investment, please get in touch with one of our experts.

This article was co-authored by Georgie Hughes, Solicitor in our Real Estate team.