In Cover to Cover | Issue 28, we reported on the transformative power generative AI is likely to have on the insurance industry, and the role it could play. We predicted that generative AI would have the potential to offer insurance brokers tools to analyse customer profiles against insurers’ offerings to match customers with the most appropriate insurers and policies, saving time for brokers and improving customer outcomes.

It is crucial for brokers to keep up to date with these developments. Two years on, we are learning of exciting new AI tools for insurance brokers that are now coming to market that promise these benefits and more. Partner, Andrew Horne, spoke to Simon Archer, co-founder and director of innovation at PolicyCheck, a new AI-based product for insurance brokers that is expected to be released soon in New Zealand.

What will PolicyCheck offer brokers?

PolicyCheck is an AI-based product we are developing that will offer brokers a range of tools to help them advise customers better and more efficiently. It will also help brokers target customers, and comply with their regulatory obligations.

Brokers will begin by inputting a customer’s requirements into PolicyCheck, either by typing them into templates or simply by downloading emails or transcripts of calls with the customer for PolicyCheck to interrogate. Brokers will also be able to invite PolicyCheck to a call with a customer so it can learn their requirements in real time. It will produce a list of requirements which the broker and customer can check and add more if necessary.

Once that’s done, the system will compare those requirements against its database of insurance policies and identify those that look as though they best respond to the customer’s requirements.

We are expecting many of the policies in the database to be provided by insurers, and we’re working with insurers to make them available. Brokers can also add policies they have obtained from other sources, including their own proprietary products.

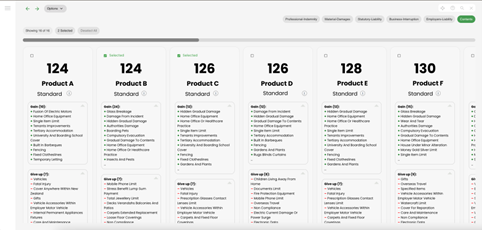

PolicyCheck will then analyse the customer’s requirements against the policies and produce a table listing the customers’ requirements down the side, the names of each insurer across the top, and a summary of what each policy offers for each requirement in the table. The summary is colour coded, so brokers will be able to see at a glance which of the policies best meet the customer’s requirements, along with other relevant information such as deductibles, premiums and additional benefits. The policies can be sorted and listed based on criteria the broker specifies.

PolicyCheck can then produce a report and a recommendation for the customer, using automated templates. This will describe what the customer is gaining or losing if it takes different policies. It won’t list everything, because there are too many differences between policies for that to be practical, so it will prioritise those that look to be most important to the customer based on its instructions. A screen will show premiums and commissions.

Once the customer has made a decision, PolicyCheck can produce a draft proposal form to the insurer, based on the customer’s documents and instructions.

The system will also track customer interactions and use approved messaging to help brokers with regulatory compliance. It will keep a record, for instance, of customers’ decisions to opt out of cover, or whether they declared prior claims or provided other relevant information.

What else does it offer?

We’re working on a number of additional features we think brokers will find useful. For example, we are working on a feature to help brokers working in areas in which they may be less familiar or where they want reassurance that they have asked questions that are relevant to the customer’s risk. We see this as a ‘risk coach’, where the system suggests questions the broker might ask a customer who is in a particular line of business. For instance, if the customer is in the hospitality industry, the system might suggest questions about food standards compliance.

The system will also be able to go through the customer database and identify where customers may have opted out of cover that other customers are taking, or suggest other possible conversations.

We are also looking at developing an automated claims management tool.

Does this reflect what brokers are telling you they want?

Brokers are telling us they want one system that does everything in one place – taking customer instructions, comparing policies, providing reports and issuing documents. We’re aiming to provide that with PolicyCheck.

How reliable are the answers?

We’re starting with AI-driven highlights as AI is still some ways off from fully accurate policy interpretations, especially when confronted with complex wording. Rather than delivering black-or-white inclusion/ exclusion verdicts, our goal is to speed up the review by flagging the sections and clauses that deserve closer inspection. Brokers, lawyers, and clients remain responsible for confirming suitability but can leverage the AI’s insights to empower deeper understanding and to focus their expertise and attention where it matters most.

With every policy uploaded and each interaction feeding back into the model, the AI-driven highlights will become increasingly precise, making the review process faster and more reliable over time.

What types of policies will be offered?

We are starting with home and vehicle insurance, which are relatively straightforward products. Once we are happy that the system is working as we want it to, we expect to expand the offering to a wide range of policies including life, health, travel, business, professional indemnity, cyber, and even speciality policies such as agricultural and aviation risks – even reinsurance.

When do you expect PolicyCheck to go live for brokers to use?

We’re expecting the first tools to go live this year. We’ll start with the tool that takes customers’ requirements and compares them against a database of policies to produce a table of recommendations, and expand it from there.

Should brokers be worried that AI tools such as PolicyCheck will take their jobs?

We see this as an enabler for brokers, rather than a threat. We think these features will help brokers do much less procedural and administration work which will free them up to spend more time on sales and business development.

Where do you operate?

Our founders are in NZ and Australia, so our focus is on the needs of local brokers and insurers. We are keen to speak to brokers who may be interested in using our products, and they can contact us or book a demonstration through our website at policycheck.co.nz.

Example of a PolicyCheck comparison table