By MinterEllisonRuddWatts Partner Kate Lane and Senior Associate Allison Hancock, and Toitū Tahua: Centre For Sustainable Finance Chief Executive Jo Kelly.

Sustainable finance continues to evolve at pace here in New Zealand and around the world.

Here are our predictations around what we might see over the next 12 months.

Follow the leader

While this is changing, New Zealand and the broader Asia Pacific region has traditionally been a follower rather than global leader in sustainable finance markets.

Offshore, Green Bonds have typically been the leading sustainable finance product by volume. This has also been the case in New Zealand. Late last year, the New Zealand government announced plans to commence a Sovereign Green Bond Programme, with the first issuance later this year.

More recently, products linked to meeting key performance indicators such as sustainability-linked loans and sustainability-linked bonds are becoming more common and are commanding a greater share of the market.

Sustainability-linked products are open to a wider variety of debt seekers as they do not restrict the use of proceeds to a particular green project. This provides borrowers with greater flexibility.

Last year, we saw a sharp uptake in New Zealand sustainability-linked bank loans, with over $3 billion in loans announced to the market in 2021.[1] Globally, sustainability linked loans rose 300% in 2021 to $717 billion. [2]

There are a number of initiatives happening overseas. In some countries, governments are offering carrots rather than sticks to encourage greater use of sustainable finance products. For example, the Hong Kong and Singapore governments are offering grants to help with the cost of external reviews (external reviews are an important aspect to demonstrate the alignment of the product with the relevant industry standards).

Over the next 12 months, we expect the New Zealand market to mature with best practices continuing to develop alongside industry standards.

Protecting sustainable finance product integrity

With increasing demand for sustainable finance products, as well as diversification and innovation in this area, greater scrutiny has followed. As the market matures, we expect to see regulators paying greater attention. Indeed, Australian Securities and Investments Commission (ASIC), recently warned investment funds in Australia against ‘greenwashing’.

In New Zealand, the Financial Markets Authority (FMA) recently published its review of how managed funds are applying the FMA’s 2020 Integrated Financial Products Guidance (for financial products that incorporate non-financial factors, such as ESG, alongside financial factors). While the review relates to funds, many of the FMA’s comments could equally apply to bond issuers. The FMA says it will continue to monitor the market to prevent complacency and the entrenchment of poor disclosure.

We also expect to see industry standards and expectations continue to tighten and drive ambition as we have seen already. New Zealand’s first Stewardship Code for investors is currently being developed for a late September launch. In the National Adaptation Plan released in August, the Government committed to developing definitional tools to encourage greater investment in ‘green’ projects. The plan notes that a ‘green’ taxonomy to identify a common definition of climate and nature-positive investments could help guide businesses that are investing in adaptation and mitigation to protect against greenwashing, as well as support greater international investment in New Zealand’s climate-resilient projects, including nature-based solutions.

It is vital to the integrity of sustainable finance that transparency and ambition remain key pillars of sustainable finance.

Why does all this matter – beyond climate change?

Sustainable finance has a crucial role to play in mitigating and adapting to climate risks and financing New Zealand’s transition to net zero emissions by 2050.

Accordingly, Toitū Tahua (the Centre for Sustainable Finance) was established to coordinate, accelerate and monitor implementation of the Sustainable Finance Forum’s 2030 Roadmap. The Centre’s approach to implementation has been to convene a growing network, which currently consists of more than 80 market participants, collaborating across the eleven recommendation areas of the Roadmap.

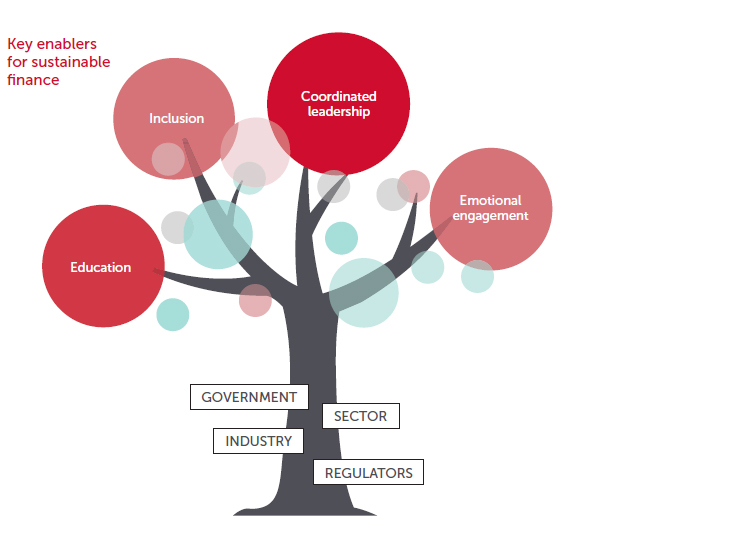

Insights from the Centre’s inaugural Partners’ Gathering reinforced that key enablers identified in the Roadmap, such as inclusion, education and coordinated leadership (from industry, the financial sector, government, regulators) are paramount for achieving the level of transformation required to enable sustainable finance at scale and realize an equitable transition to Net Zero by 2050.

Partners of the Centre readily recognise that talent has a significant role to play in sustainable finance, both in terms of increasing financial sector capability and the employer value proposition. The draw of sustainability, especially to younger generations who expect demonstrable progress, cannot be understated. Organisations that ‘lock in’ sustainability performance, by utilising sustainable finance products such as sustainability-linked loans, are realising cultural, recruitment and other benefits in addition to better pricing.

Staying the course

Transitioning to Net Zero is a mammoth task, that requires us to stay the course, and preserve the integrity of sustainable finance. MinterEllisonRuddWatts will be hosting the Centre’s second partners’ gathering in early November. We can’t wait to see what comes out of that.

Footnotes

[1] How sustainable is New Zealand’s finance, KPMG

[2] Sustainable finance continues to surge in 2021, Refinitiv